Crypto Trading Psychology 101: Mindset, Biases & Risk Decisions

Every winning trader eventually learns a difficult truth: profitable crypto trading is far less about strategy and far more about psychology. Your mindset shapes how you interpret charts, how quickly you react to risk, and whether you can stick to a plan long enough to let probabilities play out. In fact, multiple studies from behavioural finance show that emotional discipline contributes more to long-term trader performance than analytical skill alone.

🎥 Watch our short video below about Crypto Trading Psychology 101.

After more than a decade studying trader behaviour across spot, futures, and high-volatility crypto markets, the same patterns become obvious. Traders don’t lose because they lack information – they lose because they respond to uncertainty with fear, impulse, and bias. This article breaks down those psychological forces in depth and provides a practical framework for rewiring how you think, not just how you trade.

Along the way, we’ll examine how proper journaling, structured review, and even automation can dramatically improve your emotional consistency. When used correctly, tracking metrics in a trading journal, or even asking whether can AI help with tracking trades, can turn foggy hindsight into clear, actionable feedback loops. The psychological edge you build becomes its own compound interest.

Understanding the Core Problem: Emotional Decision Making in Volatile Markets

Crypto is structurally engineered for emotional disruption. The volatility is higher, the market never closes, and the social noise amplifies every candle move. Traders experience not just financial swings but biochemical swings: cortisol spikes during sudden drawdowns, dopamine hits during surprise pumps, and adrenaline during fast-moving entries.

The problem isn’t the emotion itself – it’s the decisions made during those emotional peaks. You can be a genius with Fibonacci levels and liquidity maps, but if your nervous system overrides your logic at the worst moments, the outcome will be the same as a beginner guessing at random.

The core psychological blockers typically fall into four categories:

- Fear-based decision making – such as panic selling, premature exits, or freezing when a trade moves against you.

- Impulse-driven trading – entering trades without confirmation, over-trading, or reacting to social media hype.

- Biases that distort market interpretation – including confirmation bias, anchoring, Gambler’s Fallacy, and loss aversion.

- Emotional attachments to outcomes – caring too much about being right instead of trading well.

Each of these forces is predictable, and each can be trained out with structured mental techniques, repetition, and strict process logs.

Why Psychology Matters More Than Strategy

Look at your last ten losing trades. Were they caused by a poor system, or by deviations from your system?

A strategy alone cannot save a trader who rotates between excitement and anxiety with each candle. Consistency comes from the ability to make the same intelligent decision template again and again, regardless of how you feel in the moment. Great traders aren’t fearless – they are controlled.

From a purely behavioural science perspective, three things cause traders to sabotage their own systems:

- Time pressure – crypto moves fast; the faster the candle, the faster you rush.

- Perceived opportunity cost – feeling like you’re ‘missing out’ triggers impulsive entries.

- Emotional capital fatigue – every decision consumes mental energy; over-trading drains discipline.

The solution? A structured psychological framework that replaces emotional improvisation with deliberate, pre-planned action.

The Five Mindsets That Define Profitable Traders

Across hundreds of trading interviews, coaching sessions, and data-backed performance reviews, profitable traders consistently demonstrate five shared mindsets. What’s surprising is how similar these mindsets are, regardless of whether they trade micro caps, large caps, or futures.

1. The Probability Mindset

Winning traders think in terms of long-term distributions, not individual trades. One loss means nothing in isolation. Ten losses mean little. A hundred trades start to reveal whether your edge is real. Traders with a probability mindset detach emotionally because they understand each trade is just one sample.

This mindset becomes significantly easier to maintain when you keep a structured log of metrics. Monitoring things like win rate, average R multiple, time-in-trade, and emotional state helps you stay objective. If you aren’t tracking these yet, start with a reliable framework that forces you to record your decisions consistently.

2. The Process-First Mindset

Process-first traders prioritise execution over outcome. Their internal dialogue shifts from “Did I win?” to “Did I follow my plan?” This subtle shift dramatically reduces emotional volatility, because the satisfaction comes from discipline, not result.

This mindset is especially powerful for traders who struggle with FOMO or impulsive entries.

3. The Detachment Mindset

Traders often speak about “detachment” as if it’s an emotion, but it’s a skill. To detach means to evaluate price action without projecting your desires onto it. The best traders have taught themselves to interpret data neutrally, regardless of whether they’re winning or losing.

4. The Adaptive Mindset

Markets evolve. A setup that worked six months ago may stop working tomorrow. Good traders measure performance, refine entries, and evolve edge continuously. This is where AI-assisted journaling becomes useful. Tools that answer questions like can AI help with tracking trades are not about automation – they’re about objective pattern recognition that human intuition often misses.

5. The Emotional Resilience Mindset

Successful traders make hundreds of micro-failures during their career. Emotional resilience ensures that one bad streak doesn’t cause revenge trading, abandon a good system, or blow up their account. Resilience is not innate; it’s trained through exposure, reflection, and system review.

Behavioural Biases That Destroy Trading Performance

Even experienced traders fall into predictable behavioural traps. Understanding these biases and spotting them early gives you a psychological advantage over the majority of retail traders who react emotionally without realising why.

Loss Aversion

Humans feel losses about 2.5 times more intensely than equivalent gains. This is why people hold losing trades hoping they “recover” while cutting winning trades early to “lock in profit”. The market punishes both behaviours.

Confirmation Bias

Once a trader commits to an opinion, they unconsciously seek information that reinforces their belief. In crypto, this bias is amplified by social feeds where echo chambers are common. You see bullish content when you want bullishness, bearish content when you want validation.

The Gambler’s Fallacy

This is the belief that because something has happened repeatedly, the opposite is “due”. In trading, this leads to guessing reversals without confirmation or taking impulsive counter-trend trades.

Anchoring Bias

Anchoring happens when a trader fixates on a specific price level, usually their entry. If price deviates, they judge all future decisions relative to that anchor rather than the actual market structure.

The Sunk Cost Fallacy

“I’ve held it this long, I may as well keep holding.” This fallacy traps traders in hopeless positions, particularly during extended downtrends.

Revenge Trading

Revenge trading is the most financially destructive behaviour in crypto. After a painful loss, traders attempt to “win it back” immediately, entering oversized or low-quality trades. The cycle is predictable and breaks accounts.

If you struggle with this behaviour, read a deeper breakdown on breaking repeated revenge trading – it explains how to interrupt the loop and rebuild emotional control.

Why Journaling Is the Most Important Psychological Tool in Crypto Trading

What separates elite traders from intermediate ones is not strategy. It’s self-awareness. Without a journal, you rely entirely on memory – the most biased tool you have. Your brain conveniently forgets mistakes and exaggerates victories.

A trading journal removes the illusion and replaces it with concrete evidence. The point is not to record every tiny detail, but to create a structured mirror that reveals how your behaviour produces your results.

What You Should Log (Beyond the Usual Entries)

Most traders only log entry, exit, and profit. This is useless for psychological improvement. The real value comes from logging:

- Your emotional state before the trade

- Reason for entry (not “felt good”, but objective triggers)

- Adherence to your system (0-100 score)

- Time of day (your performance may vary)

- Confidence level

- Market conditions (trend, volatility, liquidity)

- What part of the plan you violated (if any)

When you analyse this every week, patterns emerge. These patterns allow you to adjust behaviour before you blow an account. Use a structured template such as those in tracking metrics in trading journal if you’re unsure where to begin.

Paper vs Digital: Which Journal Is Better?

This question comes up constantly. I’ve coached traders who swear by handwritten logs because the physical act slows the mind, and others who can only function with digital dashboards because of the search and filtering ease.

In practice, each serves a different psychological purpose. If you’re undecided, compare the pros and cons in paper vs digital journals to see which matches your thinking style.

The Importance of Logging Losing Trades

Most traders log wins enthusiastically but avoid logging losses because it feels uncomfortable. But the psychological patterns that destroy performance live inside those losing trades. When you analyse early entries, impulsive averages, late exits, or emotional overrides, the correction path becomes obvious.

If you find yourself skipping loss logs, read logging losing trades for insights – it explains exactly why this avoidance happens and how to break the habit.

How AI Can Help Improve Your Trading Psychology

AI is not a replacement for discipline, but it’s a powerful ally for identifying weaknesses you cannot see yourself. Traders typically underestimate their emotional drift, and AI can provide structured, unemotional feedback.

AI Helps With Pattern Recognition

AI can analyse metadata from your trades (time, volatility, position size, emotional tags) and identify patterns far faster than manual review. For example, it may reveal:

- You lose more often at night.

- You overtrade after a 2R win.

- Your worst losses occur after Twitter activity spikes.

- Your risk increases after three consecutive wins.

When used correctly, these insights allow you to pre-emptively adjust behaviour. If you want to experiment with automated review tools, see can AI help with tracking trades.

Can AI Outperform Human Traders?

AI can outperform humans under specific conditions: large data volume, repetitive setups, and markets with measurable inefficiencies. But AI still struggles with chaotic environments, unpredictable news, or manipulation-heavy altcoins.

The real strength of AI is not replacing traders, but augmenting them. If you want to understand the tradeoffs between human intuition and algorithmic precision, read the deeper analysis in can AI outperform the best traders.

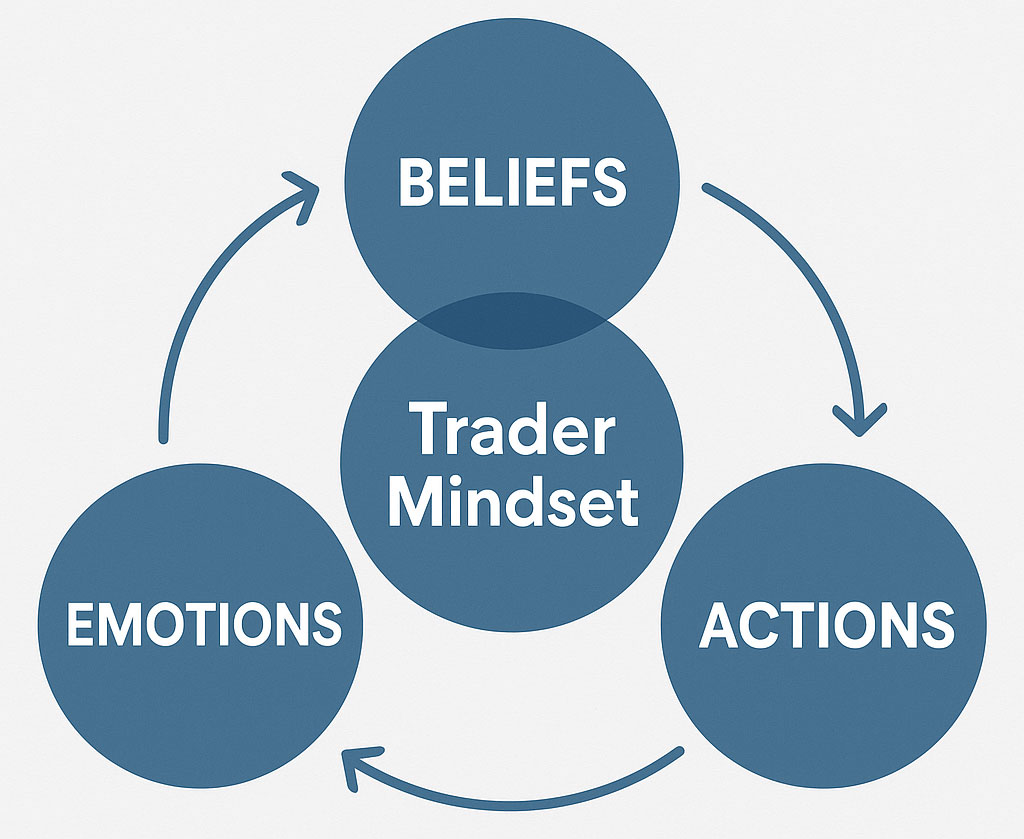

Building a Psychological Framework for Consistent Crypto Trading

The following five-step psychological framework is based on real behavioural research and the personal observations of working with traders across bull and bear markets. It is designed to keep you stable, systematic, and resilient even in emotionally disruptive conditions.

Step 1: Stabilise Your Emotional Baseline

Before trading, your nervous system must be calm. Most traders enter the market already emotionally charged – lack of sleep, caffeine spikes, stress from work, social distractions. Stabilising your base state gives you the clarity needed to spot good setups and avoid impulsive trades.

Use these techniques:

- Deep breathing for 60 seconds before placing any trade.

- Define a maximum trade count before you start (e.g., “I will take 3 trades today”).

- Rate your emotional state (1-10). Avoid trading above 6.

Step 2: Define Your Rule Set Clearly

A psychological rule is as important as a technical rule. Examples:

- You do not average down under any condition.

- You do not re-enter immediately after a stop loss.

- You stop trading after hitting your daily loss limit.

The more pre-defined these rules are, the more armour you have against emotional swings.

Step 3: Slow Down Your Decision Cycles

Impulsive trades collapse when you create a 30-second buffer between idea and entry. During that buffer, ask:

“Would I take this trade if someone else suggested it to me?”

If the answer is no, your emotions are driving the decision.

Step 4: Conduct Structured Post-Trade Analysis

Immediately after closing a trade, log:

- Did I follow the plan?

- Where were my emotions strongest?

- What would I change next time?

This closes the psychological loop. Without review, you repeat mistakes unconsciously.

Step 5: Weekly Deep Review

End each week with a full inspection of:

- Your win/loss clusters

- Your adherence percentage

- Your emotional trigger patterns

- Your risk-to-reward behaviour

This is the level where journaling or AI assistance provides exponential value. It creates feedback loops that naturally improve discipline and reduce emotional volatility.

Advanced Techniques to Rewire Emotional Responses in High-Volatility Trading

Technique 1: Behavioural Conditioning

This method uses small rewards and punishments to reinforce discipline. For example:

- After following your stop loss perfectly, reward yourself.

- After deviating from your plan, enforce a break.

The point is not the reward but the association: discipline becomes positive; emotional trading becomes negative.

Technique 2: Emotional Rehearsal

Think of this like a mental drill. Before trading, imagine losing two trades in a row. Imagine price hitting your stop. Imagine missing a huge pump. Now rehearse the correct response. This conditions your emotional system to handle these situations with less panic.

Technique 3: Psychological Distance

This technique creates separation between identity and outcome. For example, refer to your trades in third person: “The trader is considering entering here.” This subtle shift reduces the personal attachment to each decision.

Technique 4: Risk Normalisation

If your position size triggers emotional reactions, reduce it. The correct position size is the one where your heart rate doesn’t spike. Over time, you can increase size gradually as your emotional tolerance improves.

Technique 5: The Anti-FOMO Protocol

Most FOMO trades happen during green candles with high social noise. Use this protocol:

- Pause for 30 seconds.

- Identify three reasons not to enter.

- Wait for a structural pullback.

- If still valid, enter with half-size.

This breaks impulse loops and forces rationality.

Common Misconfigurations That Sabotage Trading Psychology

Even experienced traders make setup and behavioural mistakes that amplify emotional instability. These are the most common.

Misconfiguration 1: Over-Complex Systems

Systems with 10 indicators or dozens of rules create decision paralysis. Complexity increases emotional stress. Simpler systems reduce hesitation and improve conviction.

Misconfiguration 2: No Predefined Risk Rules

Traders who size positions intuitively rather than systematically experience large emotional swings. The lack of structure creates fear during drawdowns and greed during rallies.

Misconfiguration 3: Blind Social Influence

Relying on social media signals introduces noise into your psychological environment. You trade someone else’s emotions, not your own system.

Misconfiguration 4: Lack of Trading Boundaries

Trading while tired, angry, hungry, distracted, or socially influenced destroys performance. You must set boundaries just as athletes set training conditions.

Misconfiguration 5: Undefined Journaling Habits

Writing a journal only when convenient collapses the psychological value of journaling. Consistency is the entire mechanism of improvement.

Checklist: The Daily Psychological Conditioning Routine

Use this quick reference before every trading session.

Pre-Trade Checklist

- Emotional state rated under 6/10

- Clear, predefined max loss for the day

- System rules reviewed once

- No external noise (Twitter, Discord, YouTube) influencing bias

- Position size pre-set

During-Trade Checklist

- Breathing steady

- No moving stop loss away from risk

- No impulsive re-entries

- No doubling size after losing trades

Post-Trade Checklist

- Log emotion, adherence, mistakes

- Rate discipline 0-10

- Walk away for 2 minutes before next decision

Conclusion: Master the Mind, Master the Market

You cannot eliminate emotion. But you can rewire how you respond to it. The traders who succeed long-term are not the ones who predict the market most accurately – they are the ones who behave most consistently. Your journal, your rules, your mental rehearsal, and your weekly review create the psychological edge that compounds over time.

When you start treating trading psychology as a skill – not a personality trait – you build resilience, discipline, and clarity. If you apply the frameworks in this article, your future self will look back with surprising gratitude. This is where real progress begins.

Crypto Trading Psychology 101 FAQs

Because strategies are easy to follow when nothing is at risk. Once money, volatility, and uncertainty enter the picture, emotional reactions override logic. The majority of failures come from inconsistent behaviour, not flawed systems.

Most traders see noticeable improvement in 3-6 weeks of consistent journaling and weekly reviews. The full behavioural shift typically takes 3-6 months.

Paper journals slow thinking and improve emotional awareness. Digital journals allow deeper analysis and pattern recognition. See paper vs digital journals for pros and cons.

Not entirely. AI excels at pattern recognition, but human traders still outperform in chaotic, low-liquidity, or manipulation-heavy conditions. The best results come from hybrid human-AI workflows.

Interrupt the loop by forcing a cooldown period, reducing size, analysing the emotional trigger, and implementing strict rules. Read the detailed guide on breaking repeated revenge trading for a structured method.

please consider sharing!: