Crypto Trading Journal: Advanced Features and Benefits for Better Crypto Trading

Crypto markets move fast, and keeping a trading journal might be the most underrated secret to improving your performance. Charts and news are important, but if you’re not also tracking your own decisions and emotions, you’re missing a critical data source – yourself. Using a trading journal for logging crypto trades provides insight into why you made each decision and how to refine your strategy. As touched upon nicely by the artcile on prices.org detailing Why Every Beginner Crypto Trader Should Be Using a Trading Journal, we’ll also explore what a crypto trading journal is, the advanced features that make it invaluable, and how it helps you become a more disciplined, successful trader.

Create your free account with Crypto Mental Log and start using your online trading journal today.

What Is a Crypto Trading Journal?

A trading journal (sometimes called a trading diary or cryptocurrency trading log) is a record where you document everything about your trades. It’s more than just a list of buy/sell transactions – it’s a detailed diary of your trading mindset and strategy. In a trading journal, you typically log:

- Trade details and outcomes: What asset you traded, when you entered/exited, and the result (profit or loss).

- Your emotional state: How you felt before the trade (confident, anxious, greedy?) and after the trade (relieved, disappointed, calm?). A clear primer on the role of sentiment is here: CoinMarketCap Academy — Market Sentiment

- The reasoning behind the trade: The setup or strategy you used and why you decided to take the trade.

- Mistakes or wins: Note any errors you made (e.g. moved your stop loss too soon) or things you did well.

- Lessons learned: Every trade has a lesson. Write down what you learned so you can recall it later. If you need a neutral explainer on risk concepts, see CME Group — Intro to Risk Management.

In short, your trading journal is a personal performance tracker — a mirror into your trading behavior and thought process. It helps you become more self-aware and turn each trade into an opportunity to improve.

Why Many Traders Skip Journaling (and Why That’s a Mistake)

Surprisingly, many crypto traders don’t keep a journal. Common excuses include:

- “It’s too tedious or not worth it.” Some traders think writing notes is extra work with no immediate payoff.

- “I only care about P&L.” If they’re making money, they might ignore why or how it happened. If losing, they may not want to dwell on it.

- “Facing my emotions is uncomfortable.” Writing down that you panicked or got greedy can feel awkward, so they avoid doing it.

However, these are exactly the reasons why journaling is so powerful. Yes, it takes effort – but that effort shines a light on your blind spots. By keeping a trading journal, you expose patterns in your behavior you wouldn’t otherwise notice, helping you break bad habits and emotional cycles. It’s a bit like having a coach or therapist on paper: it forces you to face the truth of your decisions. Over time, this practice builds discipline and can dramatically improve your decision-making.

In fact, trading psychologists have found that journaling increases self-awareness, making you mindful of what you’re doing well and what needs improvement. In other words, a journal helps you see yourself objectively – and that’s a big edge in the market.

Essential Elements of a Trading Journal

Not all trading journals are created equal. A simple notebook or spreadsheet might record basic info, but a modern digital crypto trading journal (such as Crypto Mental Log) provides advanced features that capture every aspect of your trade. Here are the key inputs and sections you should include in a comprehensive crypto trade journal:

- Log Date & Time: Recording the date and time of each trade entry is fundamental. This provides context about market conditions (was it during a news event or a weekend lull?) and helps order your journal chronologically.

- Market Sentiment Rating (1–10): A numerical sentiment or market confidence score for each trade. For example, before entering, rate how bullish or bearish you felt on a scale of 1–10. This quantifies your gut feeling and emotional bias at the time. Over time, you can spot if low-sentiment trades perform better, or if overconfidence (a 10/10 sentiment) tends to precede mistakes.

- Trade Title & Rationale: Give each trade a brief title or description and write down why you took it. For instance, “BTC Breakout on ETF News” or “ETH oversold bounce.” Explain the setup or strategy (e.g. breakout, trend reversal) and the reasoning behind it. Writing a rationale forces you to articulate your strategy, ensuring you have a reason beyond FOMO or a random tip.

- Entry and Exit Prices: Document the exact price at which you entered the trade and the price at which you exited. These numbers are critical for later analysis – you can calculate your return and also see if you executed near optimal prices or jumped in too late/early.

- Position Size, Timeframe, and Strategy: Note how large the position is (e.g. 5 ETH, or 10% of portfolio), what your timeframe is (day trade, swing trade, long-term hold), and the specific strategy or indicators used. For example, “Position: 2 BTC (20% of account), Timeframe: 1-week swing, Strategy: Moving average crossover.”

- Profit/Loss Outcome: Calculate the profit or loss from the trade, in both percentage and dollar terms. For example, “+5% gain, +$500.” Logging the P/L isn’t just about bragging rights – it lets you evaluate whether the trade met your expectations and if your risk management was on point. Over many trades, you’ll see your average gains, losses, and risk-reward ratios.

- Emotional State (Before & After): Write a short note on how you felt before entering the trade and after exiting. Were you nervous, excited, fearful, greedy? After the trade, did you feel regretful, calm, euphoric, frustrated? Being honest about your emotional state helps you identify patterns. Maybe you notice that impulsive, emotional trades (made when you were angry or impatient) tend to be losers, whereas trades made when you felt calm and focused tend to win. This insight is gold for improving your psychology.

- Post-Trade Review: Finally, include a brief review once the trade is done. Ask yourself: Did this trade go according to plan? Did I follow my rules? What went well and what went wrong? Jot down any lessons learned. For example, “Lesson: My entry was good, but I moved my stop too early,” or “I got scared by a dip and exited too soon – need to trust my strategy next time.” The post-mortem is where you turn experience into improvement. It cements the learning so you (hopefully) don’t repeat the same mistakes.

By diligently recording these details for each trade, your journal becomes an incredibly rich database of your trading life. All these inputs work together to give you a 360° view of each trade – not just what you did, but why you did it and how you felt. That level of detail is what makes a trading journal for crypto traders so valuable.

How These Journal Inputs Help You Trade Better

Filling out a detailed journal like this might seem like a lot of work, but each component is there to help you trade smarter. Here’s how these inputs translate into real benefits for your trading:

- Emotional Control & Self-Awareness: Writing down your feelings and giving yourself a sentiment score makes you more aware of your emotions. Over time, you’ll spot patterns – for example, you might discover that whenever you felt 10/10 confident, you over-leveraged and the trade went badly. Or you might see that trades you entered when feeling anxious often turned out to be mistakes. Recognizing these patterns helps you manage and avoid impulsive, emotion-driven trades. In other words, your journal acts like a mirror, showing when fear or greed crept in. This awareness is the first step toward emotional control. Instead of reacting blindly to market swings, you learn to pause and follow your plan, making decisions based on strategy rather than stress. As one trading psychologist notes, journaling is an “evidence-based” method that improves self-awareness and mindfulness of what you do well and what needs work – critical for keeping emotions in check.

- Faster Learning & Strategy Improvement: A crypto trading journal is essentially your personal textbook of trading. Every entry is a case study of what worked and what didn’t. By reviewing your own trades, you accelerate your learning curve. You’ll quickly see which strategies are consistently profitable and which ones fail. For example, your notes might reveal that your trend-following trades yielded steady profits, whereas those impulsive short-term scalps kept hitting stop loss. With this information, you can fine-tune your approach, focus on strategies that play to your strengths, and avoid those that don’t. Without a journal, it’s easy to forget why a trade went wrong and repeat mistakes. With a journal, each mistake becomes a lesson you won’t forget. This kind of deliberate practice – logging trades and then studying them – leads to continuous improvement in your trading skills.

- Discipline & Consistency: The very act of maintaining a trading journal instills discipline. How so? When you commit to recording every trade, you create a routine and a set of rules for yourself. You know you have to write down why you’re entering a trade before you do it – which stops a lot of sloppy trades in their tracks. Nobody wants to jot down “I went all in on a meme coin because I was bored”! By enforcing a habit of planning and reflection, your journal keeps you consistent. It’s much harder to stray from your trading plan when you are tracking your actions so closely. Over time, this consistency in process leads to more consistent results. You start treating trading less like gambling and more like a structured business. And if you ever do start slipping (say, taking a string of impulsive trades), reviewing your journal will quickly call you out and guide you back to discipline.

- Accountability & Continuous Motivation: Even if you’re a solo trader, a journal makes you accountable to someone – your future self. When you have to answer to your journal, you think twice about taking a poorly thought-out trade because you know you’ll be writing about it later. In this way, the journal acts like a mentor looking over your shoulder. This accountability can be a powerful motivator to stick to your rules and avoid destructive behavior. Moreover, a journal lets you celebrate progress. You can look back six months and see how much you’ve learned and improved, which boosts your confidence. It’s encouraging to see, in black and white, that you’ve tightened up your risk management or that your average loss has gotten smaller. That positive reinforcement makes it easier to stay committed to your trading goals.

Multiple trading experts affirm these benefits. A well-kept trading journal helps you track your behavior and outcomes, making you aware of patterns that impact your performance. It effectively removes much of the bias and emotion from your decision-making by laying out the facts of your performance. The result is that you approach trades with a clearer, cooler head and a focus on continuous improvement.

Visual Journaling: See Your Crypto Trades on the Chart

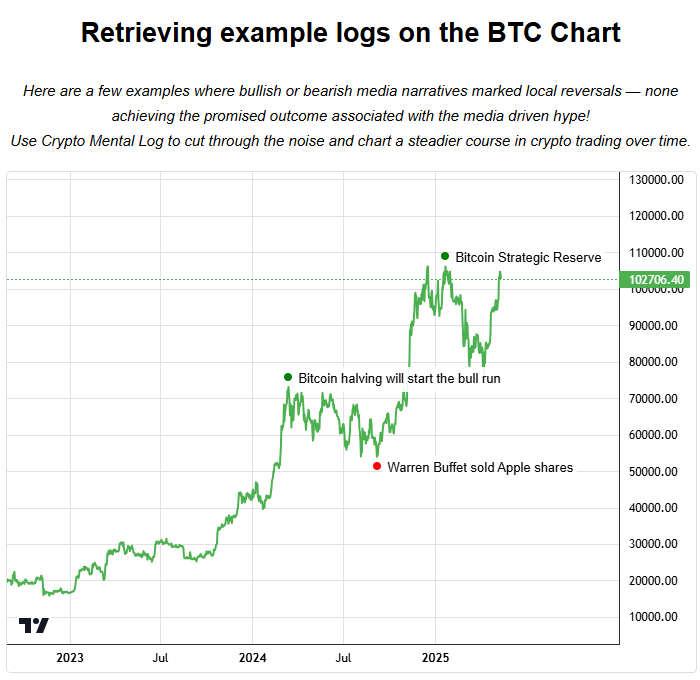

Overlaying journal notes directly on a BTC/USDT chart on TradingView charts makes review 10x more insightful. For example, anchor a note at the candle where you bought BTC on “ETF rumor momentum,” then another where you felt fear and exited. When you replay it later, you’ll see iwhether your emotion aligned with structure.

See how we integrate TradingView charts with our journal software in a unique way which you will not find anywhere else.

Figure: Example journal entries (as notes) overlaid on a custom TradingView BTC price chart using Crypto Mental Log’s interactive chart feature. Visualizing your logs this way helps you connect your strategy and emotions to actual market moves, giving deeper insight into each trade’s context and outcome.

Seeing your journal notes appear on the chart is a game-changer. Suddenly, you can connect the dots between what you were thinking or feeling and what the market was doing at that moment. Maybe you notice that a series of bullish news headlines in your notes actually coincided with local price tops (rather than breakouts) – a sign that chasing hype was a mistake. Or perhaps you see your note about “panic selling” appears just before the price rebounded sharply, showing that emotion caused you to exit too early. By having these annotations on the chart, you get immediate visual feedback on your decisions. It cuts through hindsight bias because you can literally see how your real-time mindset lined up with subsequent market movements.

This kind of visual journaling builds both confidence and insight. Over time, you’ll trust your process more because you have a visual record proving that your strategy (when followed) works better than your moments of fear or greed. It also makes reviewing your history much more engaging – instead of sifting through spreadsheet rows, you’re replaying your trading story on the chart. You can scroll through time and watch your evolution as a trader, with notes marking lessons learned along the way. In short, the interactive chart integration turns your journal into an actionable roadmap, helping you correlate emotions with outcomes at a glance and keeping you focused on objective market data rather than noisy narratives.

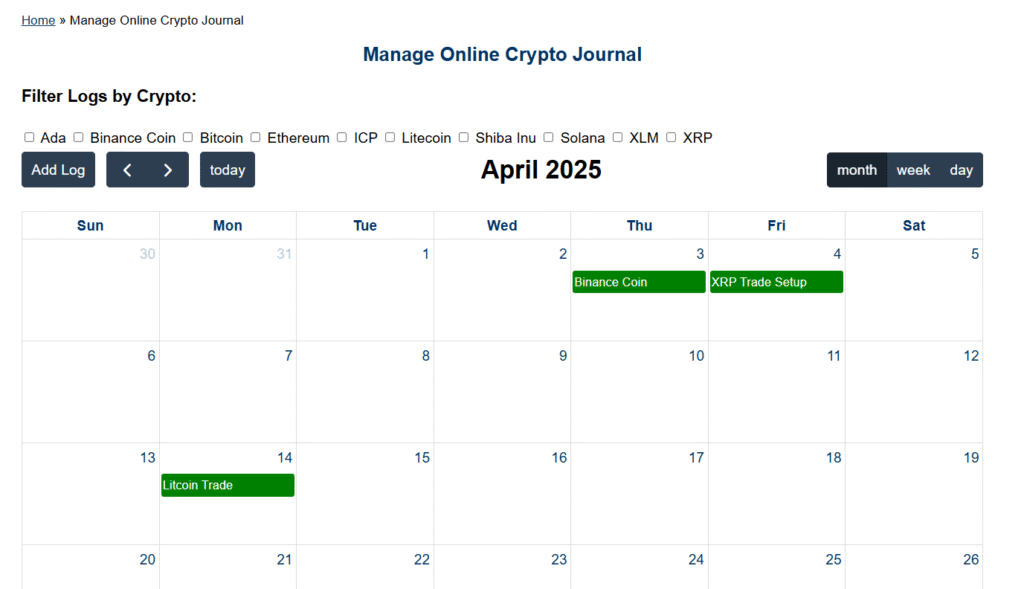

To manage journals you have a really simple calendar display, which can be filtered by your cryptocurrency of choice

Figure: Example showing calendar management on online crypto trading journal entries.

Why Use a Online Crypto Journal Tool?

By now, the benefits of journaling should be clear. You might wonder, can’t I just do this with a pen and notebook, or a simple spreadsheet? You could, but using a dedicated digital crypto trading journal tool like Crypto Mental Log offers some major advantages that make the process easier and more effective:

- Accessibility: A cloud-based journal is available on all your devices. Whether you’re at your desktop or on your phone, you can quickly log a trade or review past entries anywhere, anytime.

- Structured Templates: Digital journals often provide clean templates and forms for entry. This keeps your logging consistent. You won’t forget to record a crucial detail because the form guides you through all the fields (like date, price, sentiment, etc.). Consistency means your data is standardized, which makes analysis much more effective.

- Privacy & Security: A good trading journal app keeps your data private and secure (usually with encryption and secure cloud storage). You don’t have to worry about losing a physical notebook or an Excel file getting corrupted. Your sensitive trade data and personal notes stay safe.

- Emotional & Performance Tracking Combined: Unlike generic note apps, a crypto-focused journal tool is designed for traders. Crypto Mental Log, for example, is built to track both trade performance metrics and emotional metrics. This integrated approach means you can see, say, how your 8/10 confidence trades fared versus your 5/10 confidence trades at the click of a button. It’s like having a trading coach and a performance analyst in one.

- Searchable and Analyzable: Digital journals let you sort and search through your entries easily. Want to see all your Bitcoin trades where you felt “fearful”? Or filter trades by a particular strategy or timeframe to gauge success rates? A good tool will let you tag or filter entries, making pattern recognition much faster. Some platforms even generate reports or stats from your journal data automatically, highlighting things like win-rate by strategy, average hold time, etc. This insight would be tedious to compile manually.

In essence, a dedicated trading journal platform streamlines the process of journaling and maximizes the insights you can gain from it. It reduces the friction of keeping a journal (no more scribbling by hand during volatile market hours) and enhances what you get out of it – like the interactive chart annotations and analytics that bring your journal to life. The easier and more useful journaling is, the more likely you are to stick with it and reap the rewards.

Start Your Trading Journal and Level Up Your Trading

The bottom line: a crypto trading journal is one of the best tools you can give yourself as a trader. It brings structure, self-reflection, and continuous learning into your routine. Most traders obsess over finding the next hot coin or the perfect technical indicator, but the real competitive edge often comes from mastering your own mind and habits. A journal helps you do exactly that by turning subjective experiences into objective data you can review and improve upon.

If you’ve never kept a trading journal for crypto, the best time to start is now. Don’t worry – it doesn’t have to be overwhelming. Begin with your very next trade. Jot down the date, what you’re trading, why you’re trading it, how you feel, and what happens. Use the advanced features we discussed: rate your sentiment, note your emotions, record the outcome, and write a brief reflection. It might feel a bit tedious for the first few entries, but as soon as you review your notes, you’ll start seeing the value. Those “aha” moments – “I can’t believe I always sell at the bottom when I get scared!” or “These trades where I followed my plan are mostly winners!” – are incredibly motivating.

Consider using a tool like Crypto Mental Log to make this process easier and more effective. You’ll be able to input all those details quickly and even see your notes on the chart, which makes analysis much more intuitive. The sooner you start journaling, the sooner you’ll have a treasure trove of personal trading data to guide you.

Ready to improve your trading performance and psychological resilience? Start using a crypto trading journal today and turn every trade into a lesson. With each log you’ll be building discipline, learning from mistakes, and reinforcing what works. Over weeks and months, you’ll likely find that this habit not only boosts your profitability but also gives you greater confidence and emotional control in the wild world of crypto trading. Don’t let another trade slip by unnoticed – grab a journal (or sign up for a digital one) and make your trading journey the insightful, disciplined process it’s meant to be. Happy journaling, and happy trading!

Trading Journal FAQs

A crypto journal is a structured record where you document every cryptocurrency trade’s details—entry and exit prices, position size, timeframe, strategy—as well as your emotional state, decision rationale, profit/loss outcome, and lessons learned.

Journaling exposes hidden biases and emotional patterns, enforces discipline by requiring a pre-trade plan, accelerates learning through post-trade review, and ultimately helps you make more objective, consistent trading decisions.

At minimum, log the date, sentiment rating (1–10), trade title and rationale, entry/exit prices, position size, timeframe, strategy, profit or loss, emotions before and after, and a short post-trade review.

Scoring your confidence on a 1–10 scale quantifies your gut feeling for each trade. Over time, you can track whether high-confidence trades outperform low-confidence ones, helping you identify and correct overconfidence or hesitation.

Noting feelings like fear, greed, or calmness highlights patterns in your psychological responses. Recognizing these emotional triggers helps you avoid impulsive decisions and stick to your strategy under stress.

A post-trade review forces you to analyze what went right or wrong—did you follow your rules, exit too early, or move stops prematurely? Capturing these lessons cements learning and prevents repeated mistakes.

Pinning your journal notes directly onto a crypto price chart lets you correlate your strategic and emotional decisions with market movements, revealing whether hype-driven entries aligned with actual market tops or bottoms.

Yes—any format that consistently captures the key trade and emotional fields works. However, digital tools offer templates, searchable entries, analytics, and chart integrations that make journaling quicker and more powerful.

Log each trade immediately after execution to ensure accuracy, then allocate a few minutes daily or weekly to review your entries, identify patterns, and refine your strategy.

Begin with your very next trade: open your journal form, fill in the date, sentiment, trade rationale, prices, and emotions, then complete a short review afterward. Consistency is key—each entry compounds your learning and builds discipline.

Get Started for Free — No Commitment

You can try Crypto Mental Log completely free with your first 3 journal entries. Experience all the core features and see how easy it is to log your trades, track your emotions, and analyze your performance on out interactive charts. After your free trial, unlock unlimited journaling and full access to all our advanced tools for just $9.99 per month. No hidden fees, no long-term contracts — just powerful, intuitive journaling to help you trade smarter.

Related Resource: Track Your Portfolio Like a Pro

Journaling tells you how you trade; a tracker shows you what you own and how it performs. Pair your journal with our guide to choosing and using a tracker: Crypto Portfolio Tracker Tool.

If you found this content helpful,

please consider sharing!:

I love using the crypto mental log journal!

I started using the crypto mental log journal last month and it’s really helped with my trading success!